Crafting Rural FinCorp is a small microfinance institution that plays a crucial role in providing financial services to small-scale entrepreneurs, self-help groups, schools, and institutions in rural areas. We are dedicated to empowering local communities by offering access to financial resources and support for sustainable economic growth.

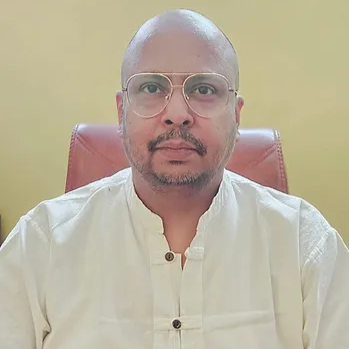

Welcome to Rural FinCorp, where we believe in empowering dreams and fostering growth in every corner of our rural communities. At Rural FinCorp, we are dedicated to supporting the aspirations of small-scale entrepreneurs, self-help groups, institutions, and individuals looking to build a better future. Our commitment to financial inclusion drives us to provide tailored financial solutions that help our clients achieve their goals and realize their full potential. With a focus on integrity, transparency, and customer-centricity, we offer a range of financial services including loans for small businesses, self-help groups, gold loans, and mortgage loans. Our aim is not just to provide financial assistance but to be a true partner in the success stories of our clients. I am proud of the team at Rural FinCorp who work tirelessly to ensure that our clients receive the best possible support and guidance. Together, we strive to make a positive impact on the lives of individuals and communities by promoting financial literacy and inclusive growth. I invite you to explore our services, learn more about our approach, and join us in our mission to empower rural entrepreneurs and uplift communities through accessible and responsible financial solutions.

We offer a range of financial empowerment programs designed to equip individuals

and communities with the knowledge and resources to make sound financial decisions.

Microfinance for Small-Scale Entrepreneurs Rural FinCorp provides small loans to aspiring entrepreneurs in underserved rural areas, fostering local economic development by helping individuals establish or grow their businesses.

The institution extends financial support to self-help groups, enabling group members to pool their resources and access credit facilities collectively. This empowers local communities to undertake entrepreneurial ventures and improve their livelihoods

Rural FinCorp recognizes the importance of education and provides financial assistance to schools and institutions in rural areas. This support helps improve educational infrastructure, access to resources, and overall quality of education in underserved communities

By offering gold loans, Rural FinCorp allows individuals to leverage their gold assets to secure immediate funds for various financial needs. This service provides a convenient and accessible borrowing option for customers who possess gold assets

At Rural FinCorp, we support a wide range of individuals and groups including small-scale entrepreneurs, self-help groups, schools, and rural institutions. Our mission is to foster financial inclusion and empowerment in rural areas.

We operate with a customer-centric approach, offering personalized financial services that are designed to address the specific challenges faced by rural communities. Our methods are built on trust, and a deep understanding of the local economic landscape.

Partnering with Rural FinCorp brings numerous benefits, including access to flexible financial solutions, expert guidance, and a supportive network committed to driving rural development economic progress.

Investing in Rural FinCorp can be a prudent choice for a variety of reasons. As one of the largest microfinance institutions in Nagaland, Rural FinCorp has established itself as a reliable and trusted financial partner in the region.

One of the key reasons to consider investing in Rural FinCorp is its diverse portfolio of financing options. The institution offers financial support to self-help groups, institutions, entrepreneurs, hostels, and individuals, providing a wide range of opportunities for investment. Whether you are looking to support community initiatives, entrepreneurial ventures, or personal financial needs, Rural FinCorp offers tailored financing solutions to meet diverse requirements.

Once you've chosen a broker, open a Rural Fincorp account with them.

Ensure you have a good grasp of the market you're trading, its terminology, and how it operates.

Decide which financial market you want to trade in, whether it's Rural Fincorp, stocks, or others